2024 1040 Schedule 5471 Instructions

2024 1040 Schedule 5471 Instructions – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 1040 Schedule 5471 Instructions

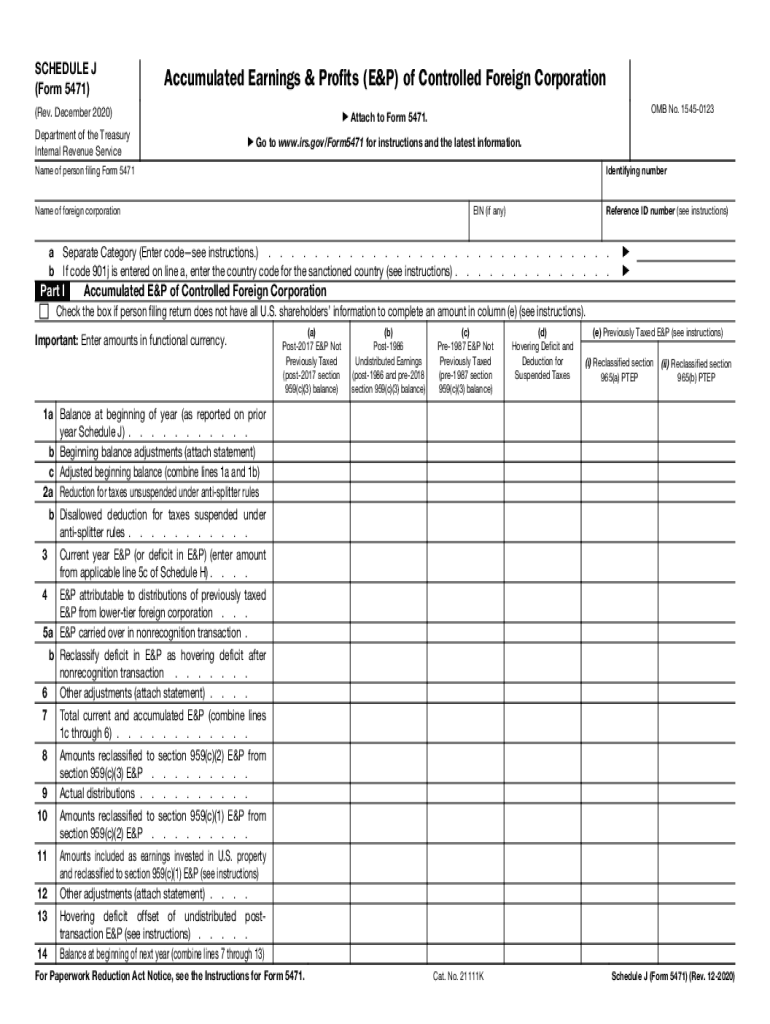

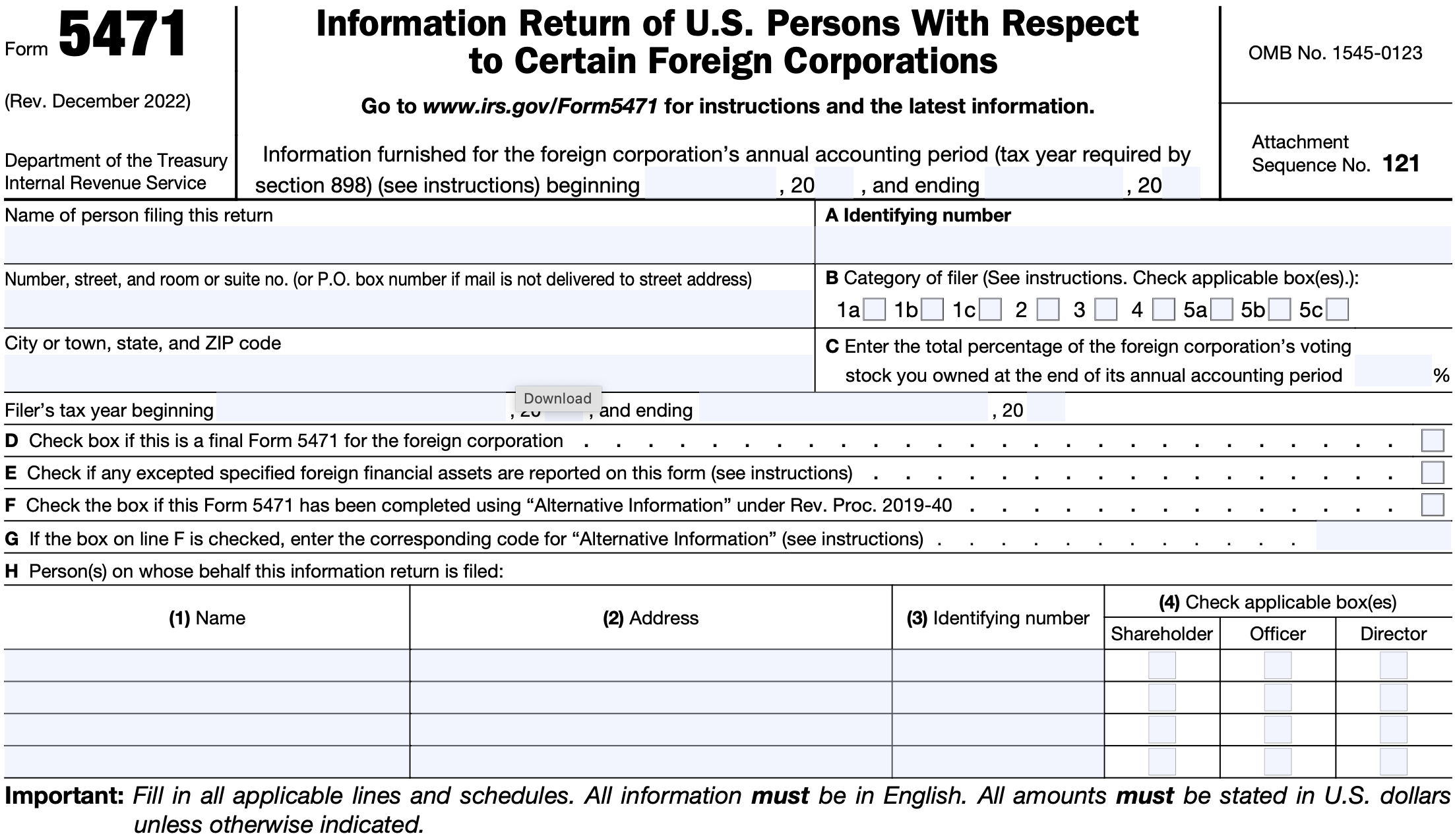

Source : www.uslegalforms.comInstructions for Form 5471 (01/2024) | Internal Revenue Service

Source : www.irs.govIrs Instructions 5471 2022 2024 Form Fill Out and Sign Printable

Source : www.signnow.comInstructions for Form 5471 (01/2024) | Internal Revenue Service

Source : www.irs.govForm 5471 instructions 2022: Fill out & sign online | DocHub

Source : www.dochub.comFORM 5471 – TOP 6 REPORTING CHALLENGES Expat Tax Professionals

Source : expattaxprofessionals.comGuide to Form 5471 Schedule E and Schedule H | SF Tax Counsel

Source : sftaxcounsel.comIRS Form 5471

Source : kruzeconsulting.comOptimise IRS Form 5471 Information & Instructions – Controlled

Source : www.optimiseaccountants.co.ukIRSMedic 2023 Form 5471 Training Guide. Lesson 2: Understanding

Source : www.youtube.com2024 1040 Schedule 5471 Instructions IRS Instructions 5471 2021 2024 Fill and Sign Printable Template : To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C .

]]>